The Company plans a management guideline for material topics annually, and the performance is monitored and reviewed in Sustainability Committee meetings. Furthermore, the increasing intensity of extreme weather in recent years indicates that the global warming crisis is reaching a tipping point; therefore, countries around the world are paying more attention to the issue of climate change, and regulations in various countries/regions are being stipulated and revised to urge businesses to incorporate climate change into their corporate management. Besides identifying climate change-related operational risks, the Company also referred to the Task Force on Climate-Related Financial Disclosures (TCFD) announced by the Financial Stability Board (FSB) to include the four core disclosures of "governance", "strategy", "risk management", and "metrics and targets" into business management. In addition, the Company's governance performance is disclosed in the ESG report, allowing the stakeholders to under-stand the impact of Corum's climate change-related risks and opportunities, as well as relevant response measures.

Governance

Corum's climate change-related discussions and management are conducted by the Sustainability Committee, while climate change-related resolutions are approved by the Board of Directors. The Sustainability Committee consists of subsidiaries including the Sustainability Office and three work teams: Corporate Governance Team, Sustainable Environment Team, and Social Engagement Team. The Sustainability Office is in charge of consolidating various work teams and generating TCFD assessment reports regularly for the Board of Directors as a reference for decision making.

Strategy

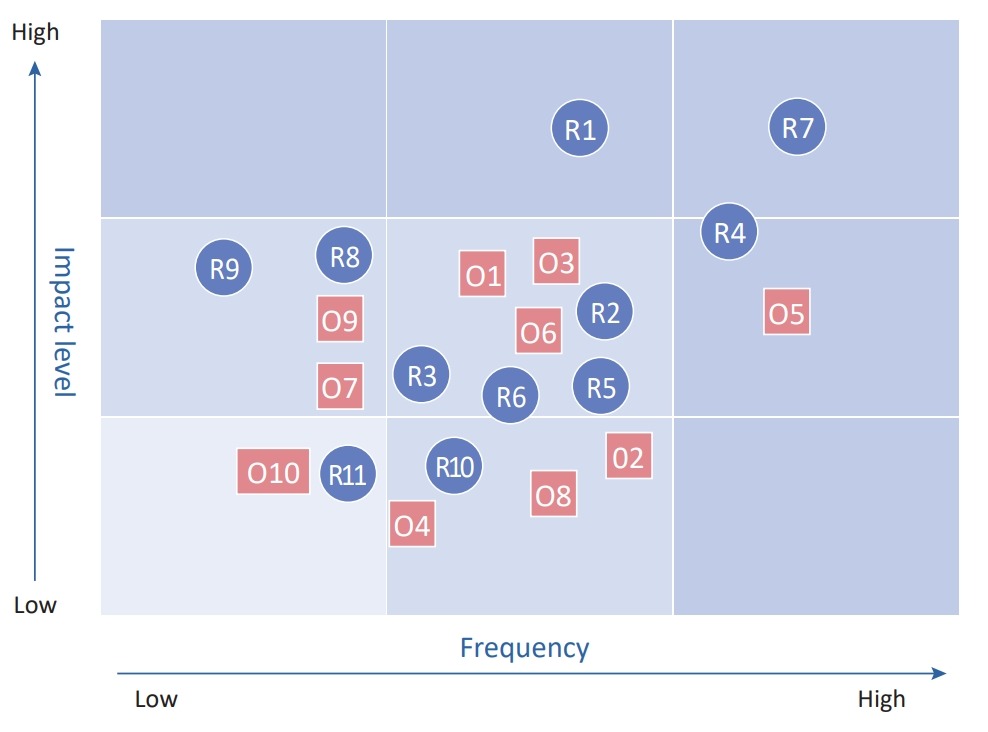

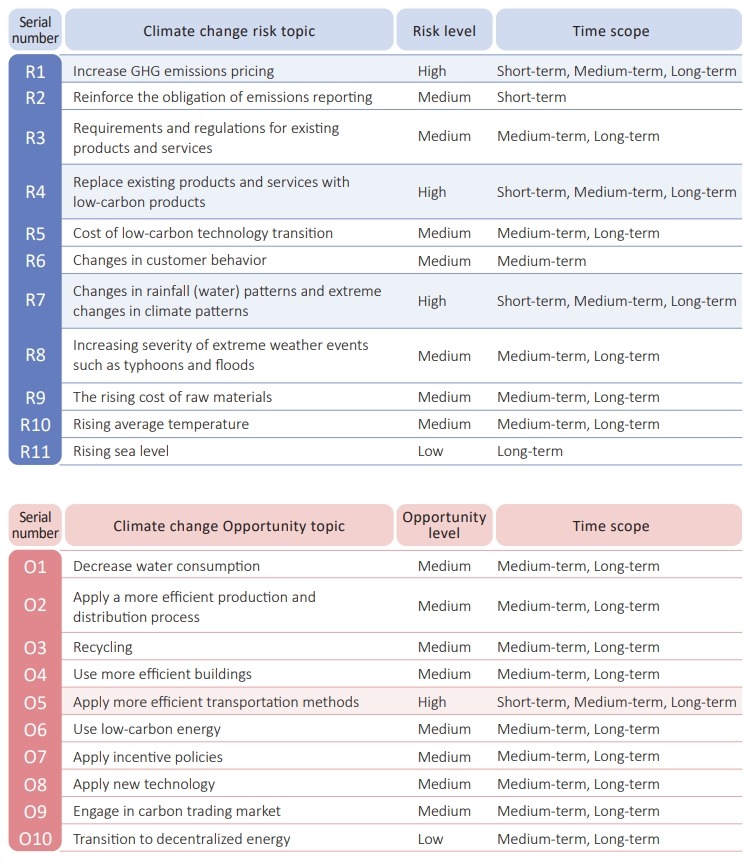

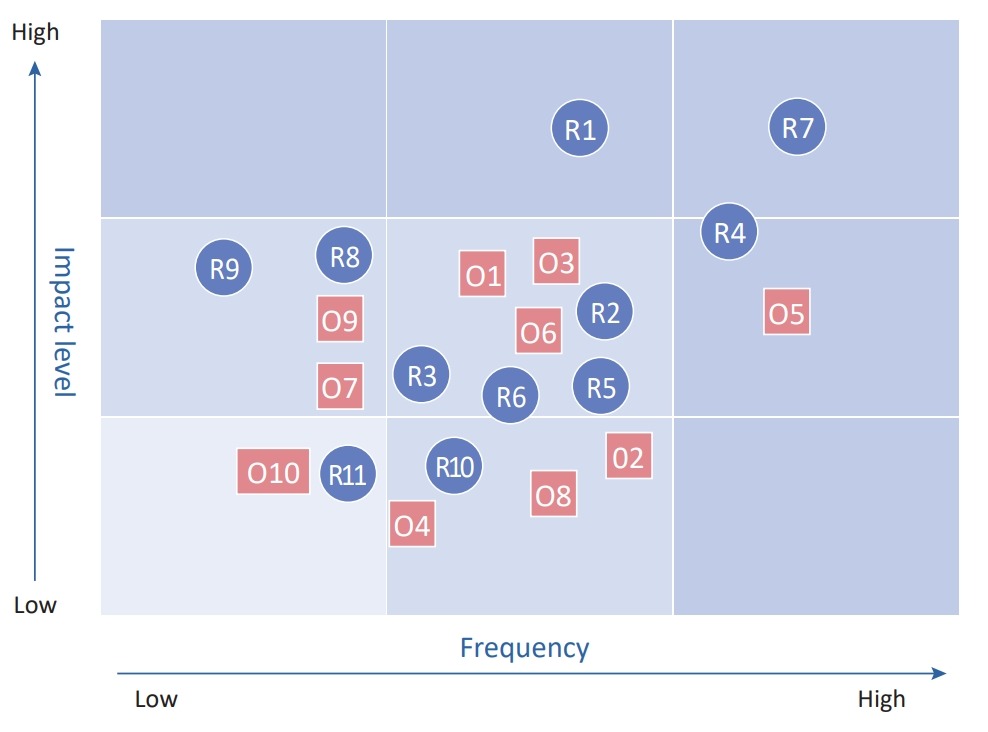

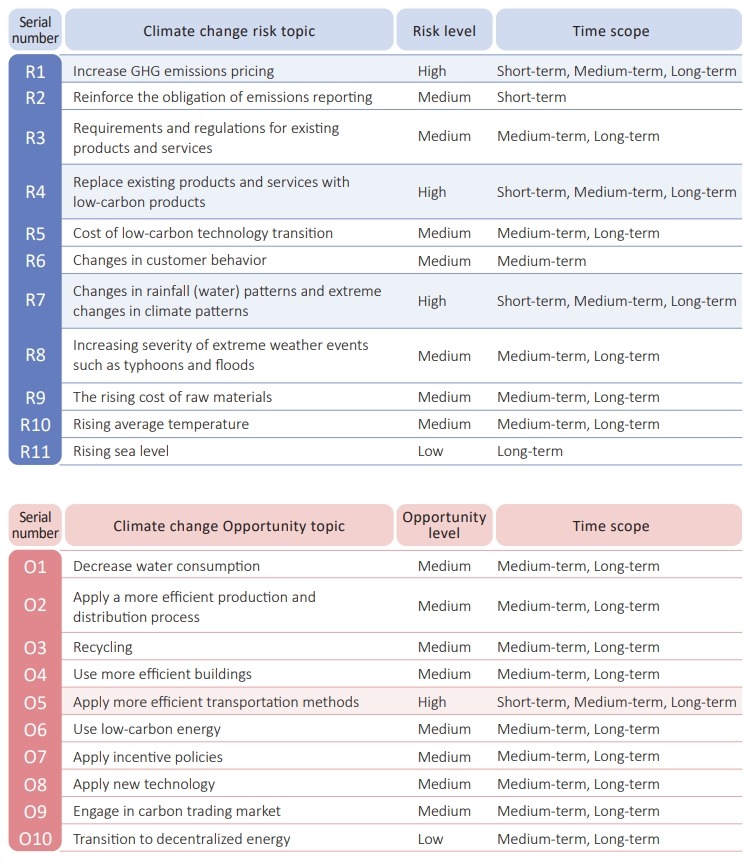

In response to the impact of climate-related risks and opportunities on the Company's strategy and financial plan, Corum has referred to TCFD's climate scenario analysis, implementing quantitative and qualitative climate scenario analyses to determine the response strategy. The Company takes into consideration the 2*C scenario (2DS) and engages in discussion at the Sustainability Committee meeting, where tools provided by the Taiwan Climate Change Projection Information and Adaptation Knowledge Platform (TCCIP) are used to assess the physical risk scenario of climate change. The 2DS/RCP2.6 scenario was chosen as the Company's climate change physical risk scenario. The topic of climate change risks and opportunities is described in this scenario, focusing on physical risks and legal transition risks. Finally, climate risks and opportunities related to the Company's operations are identified, taking into reference manufacturing industry-related TCFD reports, where the timeframe of a decade is adopted to consider the Company's long-term business development. In particular, short-term, medium-term, and long-term are defined as a period of 1-3 years, 3-5 years, and 6-10 years, respectively.

Note 1: Short-term, medium-term, and long-term are defined as a period of 1-3 years, 3-5 years, and 6-10 years, respectively

Note 2: The circle above the matrix indicates the risk topic, the square represents the opportunity topic, while major risk and opportunity topics are highlighted.

Risk management

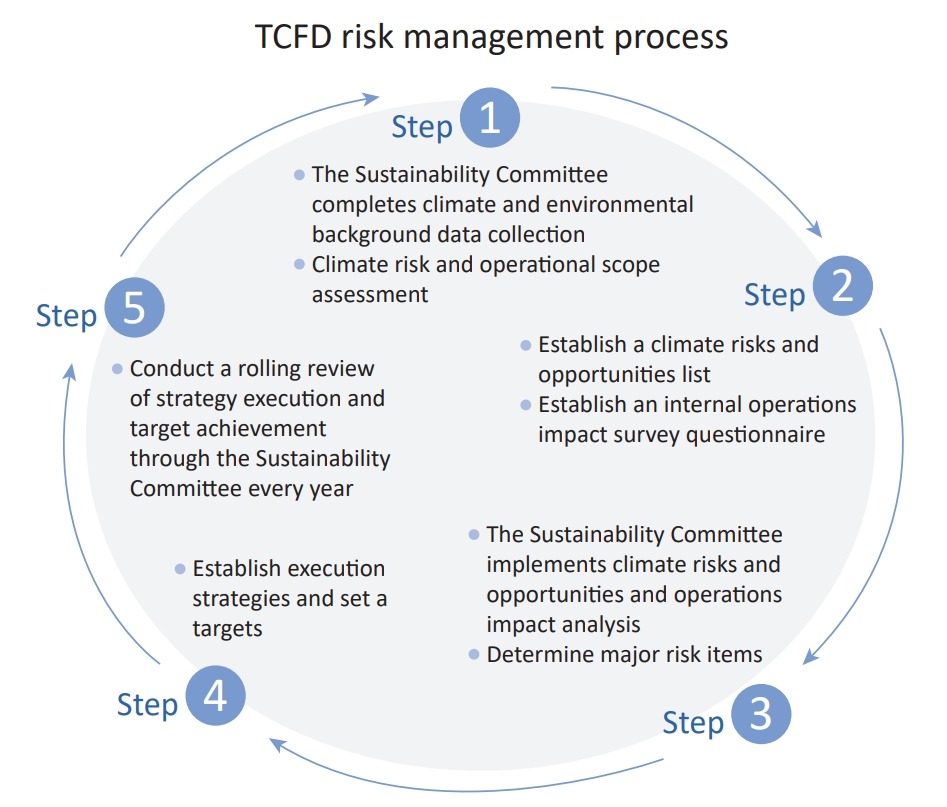

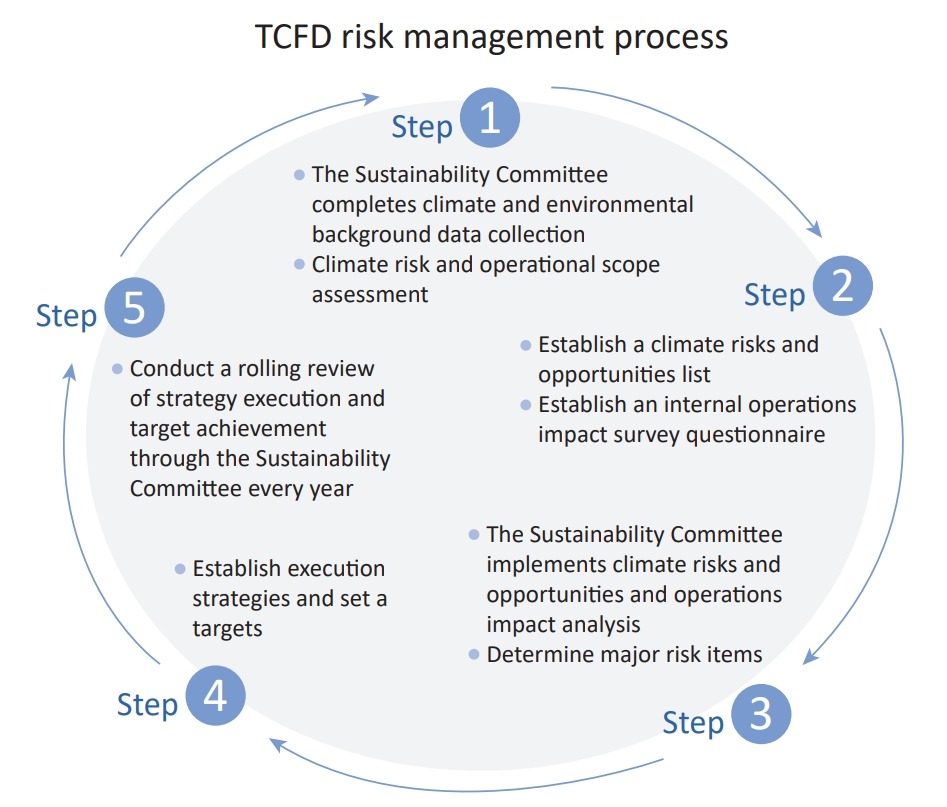

The Company's Sustainability Committee engages in discussions in the "TCFD climate change-related financial disclosure discussion meeting", which calls upon the members to discuss and identify climate change-related risks and opportunities. The structure recommend-ed by TCFD is introduced to the discussion content, while transition risks (policies and regulations, technology, market, reputation), physical risks (immediate risks, long-term risks), and opportunities (resource efficiency, energy source, products/services, markets, and resilience)are discussed and identified.

1. Transition risks: Identified two major risks including a policy and regulation-related risk and a technical risk

Description: The Greenhouse Gas Reduction and Management Act will be changed to Climate Change Adaptation Act, and carbon fees will be levied for products with high direct or indirect emissions in 2024. Furthermore, the technical risk of replacing existing products with low-car-bon products will be extended. These two risks may increase operating costs, but currently, the Company is not engaged in a high carbon emissions industry; hence the overall impact is immateria l. Besides implementing a GHG audit in 2023, the Company will also evaluate the feasibility of purchasing green electricity, installing solar power energy-saving equipment, and purchasing biomass energy. Carbon reduction targets will also be set.

2. Physical risks: Identified one major risk (immediate climate risk)

Due to the increasing frequency of extreme weather events, the resulting increase in typhoons and torrential rains may cause flooding of the Chiayi factory, in turn affecting factory operations. The potential financial loss is assessed. The Company's response measures include maintaining the drainage system and formulating a typhoon and torrential rain contingency plan to reduce the immediate risks. At present, the factory's waterproofing measures have been completed, and third-party certifications such as ISO 14001: 2015 environmental management system and ISO 45001: 2018 occupational safety and health management system have been introduced. The equipment regularly undergoes inspection and maintenance; thus the risk has an insignificant impact on the Company's overall operations.

3. Resource efficiency opportunity: Identified one major opportunity (adopt more efficient transportation methods)

Description: After considering the efficient application of various resources, the Company is expected to implement the following measures:

1. Plan the optimal transportation solution to reduce transportation costs and carbon emissions.

2. Take advantage of the CRM platform to increase distribution process efficiency, customer stickiness, and customer satisfaction in order to generate better sales forecasts and reports.

3. Continue to monitor the carbon trading market and developments in international carbon pricing to evaluate the feasibility of engaging in the carbon trading market in the future.

Note: The process describes how the Company conducts tracking and monitoring of climate change risks, collects data, and determines risk levels based on the risk matrix. The Sustainability Committee conducts an overall analysis, evaluation, and review before formulating the strategy and target. A rolling review of the performance is conducted annually.

Metrics and targets

By the end of August 2022, a total of 101 companies in Taiwan have joined the TCFD initiative . Due to the high degree of internationalization and the fast integration with the world, Corum also joined the response to support the TCFD initiative. We look forward to increasing transparency in the disclosure of climate-related risks and opportunities and further setting goals for the Board of Directors as a reference for decision making.

1. Average annual electricity saving rate of at least 1%.

2. Formulate the annual energy consumption standard value, improve and review energy consumption conditions every month, as well as allocate a budget for production process improvement and equipment replacement every year in a bid to lower energy consumption.

3. Implement a GHG emissions audit in accordance with ISO 14064-1 in 2023 to complete the self-audit GHG emissions report.

4. For the 2021 annual carbon audit, the scope 1, 2, and 3 emissions were 348.72, 1,193.15, and 94.10 tonnes of CO2e/year, respectively. The total annual emissions were 1,635.97 tonnes of CO2e/year. 2021 will be used as the base year for subsequent reduction targets to gradually reduce scope 1 and scope 2 emissions by 3% every year (intensity unit).

5. Continue to promote the consolidated shipping policy. The goal is to decrease the number of customers with more than 14 annual shipments to less than 18 by 2024. At present, the benefits of consolidated shipping in 2021 include a reduction of 28, 134 km of shipping mileage, a decrease of 17.6 tonnes of CO2 emissions, and a reduction of 68,495 KJ of energy consumption compared to 2020.

Note: TCFD official website: https://www.fsb-tcfd.org/supporters/

The Company plans a management guideline for material topics annually, and the performance is monitored and reviewed in Sustainability Committee meetings. Furthermore, the increasing intensity of extreme weather in recent years indicates that the global warming crisis is reaching a tipping point; therefore, countries around the world are paying more attention to the issue of climate change, and regulations in various countries/regions are being stipulated and revised to urge businesses to incorporate climate change into their corporate management. Besides identifying climate change-related operational risks, the Company also referred to the Task Force on Climate-Related Financial Disclosures (TCFD) announced by the Financial Stability Board (FSB) to include the four core disclosures of "governance", "strategy", "risk management", and "metrics and targets" into business management. In addition, the Company's governance performance is disclosed in the ESG report, allowing the stakeholders to under-stand the impact of Corum's climate change-related risks and opportunities, as well as relevant response measures.

Governance

Corum's climate change-related discussions and management are conducted by the Sustainability Committee, while climate change-related resolutions are approved by the Board of Directors. The Sustainability Committee consists of subsidiaries including the Sustainability Office and three work teams: Corporate Governance Team, Sustainable Environment Team, and Social Engagement Team. The Sustainability Office is in charge of consolidating various work teams and generating TCFD assessment reports regularly for the Board of Directors as a reference for decision making.

Strategy

In response to the impact of climate-related risks and opportunities on the Company's strategy and financial plan, Corum has referred to TCFD's climate scenario analysis, implementing quantitative and qualitative climate scenario analyses to determine the response strategy. The Company takes into consideration the 2*C scenario (2DS) and engages in discussion at the Sustainability Committee meeting, where tools provided by the Taiwan Climate Change Projection Information and Adaptation Knowledge Platform (TCCIP) are used to assess the physical risk scenario of climate change. The 2DS/RCP2.6 scenario was chosen as the Company's climate change physical risk scenario. The topic of climate change risks and opportunities is described in this scenario, focusing on physical risks and legal transition risks. Finally, climate risks and opportunities related to the Company's operations are identified, taking into reference manufacturing industry-related TCFD reports, where the timeframe of a decade is adopted to consider the Company's long-term business development. In particular, short-term, medium-term, and long-term are defined as a period of 1-3 years, 3-5 years, and 6-10 years, respectively.

Note 1: Short-term, medium-term, and long-term are defined as a period of 1-3 years, 3-5 years, and 6-10 years, respectively

Note 2: The circle above the matrix indicates the risk topic, the square represents the opportunity topic, while major risk and opportunity topics are highlighted.

Risk management

The Company's Sustainability Committee engages in discussions in the "TCFD climate change-related financial disclosure discussion meeting", which calls upon the members to discuss and identify climate change-related risks and opportunities. The structure recommend-ed by TCFD is introduced to the discussion content, while transition risks (policies and regulations, technology, market, reputation), physical risks (immediate risks, long-term risks), and opportunities (resource efficiency, energy source, products/services, markets, and resilience)are discussed and identified.

1. Transition risks: Identified two major risks including a policy and regulation-related risk and a technical risk

Description: The Greenhouse Gas Reduction and Management Act will be changed to Climate Change Adaptation Act, and carbon fees will be levied for products with high direct or indirect emissions in 2024. Furthermore, the technical risk of replacing existing products with low-car-bon products will be extended. These two risks may increase operating costs, but currently, the Company is not engaged in a high carbon emissions industry; hence the overall impact is immateria l. Besides implementing a GHG audit in 2023, the Company will also evaluate the feasibility of purchasing green electricity, installing solar power energy-saving equipment, and purchasing biomass energy. Carbon reduction targets will also be set.

2. Physical risks: Identified one major risk (immediate climate risk)

Due to the increasing frequency of extreme weather events, the resulting increase in typhoons and torrential rains may cause flooding of the Chiayi factory, in turn affecting factory operations. The potential financial loss is assessed. The Company's response measures include maintaining the drainage system and formulating a typhoon and torrential rain contingency plan to reduce the immediate risks. At present, the factory's waterproofing measures have been completed, and third-party certifications such as ISO 14001: 2015 environmental management system and ISO 45001: 2018 occupational safety and health management system have been introduced. The equipment regularly undergoes inspection and maintenance; thus the risk has an insignificant impact on the Company's overall operations.

3. Resource efficiency opportunity: Identified one major opportunity (adopt more efficient transportation methods)

Description: After considering the efficient application of various resources, the Company is expected to implement the following measures:

1. Plan the optimal transportation solution to reduce transportation costs and carbon emissions.

2. Take advantage of the CRM platform to increase distribution process efficiency, customer stickiness, and customer satisfaction in order to generate better sales forecasts and reports.

3. Continue to monitor the carbon trading market and developments in international carbon pricing to evaluate the feasibility of engaging in the carbon trading market in the future.

Note: The process describes how the Company conducts tracking and monitoring of climate change risks, collects data, and determines risk levels based on the risk matrix. The Sustainability Committee conducts an overall analysis, evaluation, and review before formulating the strategy and target. A rolling review of the performance is conducted annually.

Metrics and targets

By the end of August 2022, a total of 101 companies in Taiwan have joined the TCFD initiative . Due to the high degree of internationalization and the fast integration with the world, Corum also joined the response to support the TCFD initiative. We look forward to increasing transparency in the disclosure of climate-related risks and opportunities and further setting goals for the Board of Directors as a reference for decision making.

1. Average annual electricity saving rate of at least 1%.

2. Formulate the annual energy consumption standard value, improve and review energy consumption conditions every month, as well as allocate a budget for production process improvement and equipment replacement every year in a bid to lower energy consumption.

3. Implement a GHG emissions audit in accordance with ISO 14064-1 in 2023 to complete the self-audit GHG emissions report.

4. For the 2021 annual carbon audit, the scope 1, 2, and 3 emissions were 348.72, 1,193.15, and 94.10 tonnes of CO2e/year, respectively. The total annual emissions were 1,635.97 tonnes of CO2e/year. 2021 will be used as the base year for subsequent reduction targets to gradually reduce scope 1 and scope 2 emissions by 3% every year (intensity unit).

5. Continue to promote the consolidated shipping policy. The goal is to decrease the number of customers with more than 14 annual shipments to less than 18 by 2024. At present, the benefits of consolidated shipping in 2021 include a reduction of 28, 134 km of shipping mileage, a decrease of 17.6 tonnes of CO2 emissions, and a reduction of 68,495 KJ of energy consumption compared to 2020.

Note: TCFD official website: https://www.fsb-tcfd.org/supporters/